You want to offer health insurance to your employees, but the costs keep climbing. Every year at renewal, your premium jumps another 10%, 15%, even 20%. It feels like you’re throwing money into a black hole with no control over where it goes.

Sound familiar? You’re not alone. Texas small business owners are searching for better options and many are finding answers with level-funded health plans.

Level-funded plans give you the cost predictability of traditional insurance with the potential to get money back if your team stays healthy. It’s the best of both worlds, and it’s becoming one of the most popular choices for Texas businesses with 10-50 employees.

Let’s break down what level-funded plans are, how they work, and whether one might be right for your business.

What is a Level-Funded Health Plan?

A level-funded health plan is a type of self-funded insurance that’s designed for small and mid-sized businesses. Instead of paying a traditional premium that goes entirely to the insurance company, your monthly payment gets split into three parts:

- Claims Fund: Money set aside to pay your employees’ medical claims

- Stop-Loss Insurance: Protection that kicks in if claims get unexpectedly high

- Administrative Costs: Fees for the insurance company to manage the plan

Here’s the key difference from traditional insurance: if your employees’ claims come in lower than expected, you may get some of that claims fund money back at the end of the year.

With traditional fully-insured plans, the insurance company keeps everything even if your team barely uses their coverage. Level-funded plans let healthy groups share in the savings.

If you’re unfamiliar with self-funded concepts, our article on catastrophic stop-loss coverage explains how stop-loss protection works.

How Level-Funded Plans Work in Practice

Let’s walk through a simple example:

Lone Star Plumbing is a plumbing company in Fort Worth with 15 employees. They sign up for a level-funded plan with these monthly payments:

- Claims Fund: $8,000

- Stop-Loss Premium: $2,000

- Admin Fees: $1,500

- Total Monthly Payment: $11,500

That’s $138,000 per year in total payments.

Now, let’s say Lone Star’s employees are relatively healthy. At year-end, their actual claims total only $72,000 (instead of the $96,000 that was set aside in the claims fund).

What happens to the extra $24,000? With many level-funded plans, Lone Star gets a refund of part or all of that unused claims money.

Compare that to a traditional plan where the insurance company would keep every dollar, regardless of claims. Level-funding gives healthy businesses a chance to win.

Level-Funded vs Fully-Insured: Key Differences

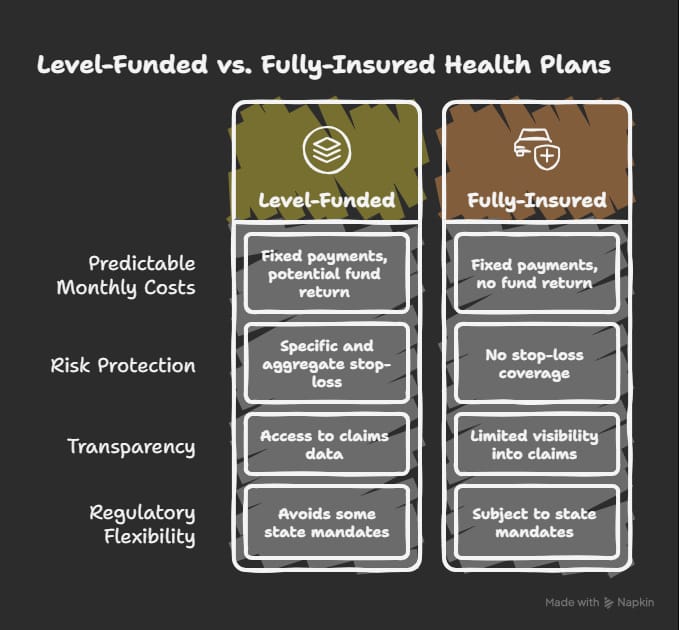

Predictable Monthly Costs

Both level-funded and fully-insured plans offer predictable monthly payments. You know what you’ll pay each month, which makes budgeting easier.

The difference comes at renewal and year-end. With level-funded plans, you might get money back. With fully-insured, you won’t.

Risk Protection

With level-funded plans, stop-loss insurance protects you from catastrophic claims. There are two types:

- Specific stop-loss: Covers any single employee whose claims exceed a set amount (often $25,000-$50,000)

- Aggregate stop-loss: Covers total group claims that exceed a certain threshold

This protection means your worst-case scenario is capped. You won’t be hit with unlimited liability like some self-funded arrangements. For more on protecting your business from large claims, read protecting your bottom line with catastrophic stop-loss insurance.

Transparency

Level-funded plans give you access to claims data and reporting. You can see how much your group is spending on healthcare, which categories drive the most costs, and where there might be opportunities to improve.

With fully-insured plans, the insurance company keeps most of this data to themselves.

Regulatory Flexibility

Because level-funded plans are technically a form of self-insurance, they’re exempt from some state insurance mandates and ACA requirements like community rating. This can result in lower costs for healthy groups. For details on ACA requirements, visit Healthcare.gov’s employer coverage guide.

Who’s a Good Fit for Level-Funded Plans?

Level-funded plans work best for certain types of businesses:

- Healthy Workforce: If your employees are generally healthy with few chronic conditions, you’re likely to see lower claims and potential refunds. Groups with younger workers or those in lower-risk industries often do well with level-funding.

- 10-50 Employees: Level-funded plans are designed for this sweet spot. Smaller groups (under 10) may face higher per-person costs. Larger groups (50+) often move to fully self-funded arrangements.

- Stable Employee Base: If your workforce is relatively consistent year-to-year, it’s easier to predict claims and benefit from level-funding. High-turnover businesses may find it harder to manage.

- Risk-Tolerant Owners: While stop-loss insurance limits your downside, there’s still more variability with level-funded plans than fully-insured. You need to be comfortable with some uncertainty in exchange for potential savings.

- Cost-Conscious Companies: If you’re tired of double-digit premium increases and want more control over your healthcare spending, level-funded plans offer a path forward. You might also explore how to reduce health insurance premiums through other strategies that work alongside level-funding.

Level-Funded Health Plan Options in Texas

Several carriers offer level-funded plans to Texas small businesses:

- UnitedHealthcare: UHC’s level-funded plans offer access to their nationwide network of 1.7 million providers and 7,000+ hospitals. They include wellness programs, telehealth, and digital health management tools. Plans can be customized with different deductible, copay, and coinsurance options.

- Blue Cross Blue Shield of Texas: BCBS offers small group plans with level-funded options for qualifying employers. They’re known for their broad Texas network and strong customer service.

- Texicare :Texicare is a Texas-focused carrier affiliated with Texas Mutual (the leading workers’ comp provider in the state). Their level-funded plans are designed specifically for Texas small businesses, with three plan options: SimplicityCare, TotalCare, and SavingsCare.

- Cigna/HealthSpring: Cigna offers level-funded options with integrated medical, pharmacy, and behavioral health benefits. Note that Cigna is rebranding its Medicare business to HealthSpring, but their small group offerings continue.

- Aetna: Aetna provides level-funded plans with various network options and plan designs. They’re a good choice for businesses that want a national carrier with a strong Texas presence.

When comparing carriers, it helps to understand what a local health insurance broker can do for you during the selection process.

Potential Downsides to Consider

Level-funded plans aren’t perfect. Here are some things to think about:

Year-to-Year Variation

Unlike fully-insured plans with guaranteed rates, your level-funded costs can change based on your group’s claims experience. A bad year with high claims could mean higher payments the following year.

More Employer Responsibility

With level-funded plans, you take on more responsibility for understanding the plan, managing costs, and communicating with employees. It’s not “set it and forget it.”

Claims Scrutiny

Insurance companies look closely at your group’s health status when pricing level-funded plans. If you have employees with significant health issues, you may not get favorable rates or may be declined altogether.

Complexity

Level-funded plans have more moving parts than traditional insurance. You’ll want to work with a knowledgeable broker who can explain the details and help you compare apples to apples. Before deciding, review 8 things Texas business owners wish they knew earlier about health insurance.

How to Get Started with Level-Funded Insurance

If you’re interested in exploring level-funded plans for your Texas business, here’s a roadmap:

Step 1: Assess Your Current Situation

How much are you paying now? What’s your claims history been like? How healthy is your workforce? Understanding where you’re starting from helps determine if level-funding makes sense. Our guide on calculating the real cost of group health benefits can help you assess your current situation accurately.

Step 2: Get Multiple Quotes

Don’t just look at one carrier. Get quotes from several level-funded plan providers and compare them against fully-insured options too. Look at the total package not just the monthly payment.

Step 3: Understand the Stop-Loss Details

Make sure you know the specific and aggregate stop-loss thresholds. What’s your maximum exposure if things go wrong? This is where the “self-funded” element comes in.

Step 4: Review the Refund Provisions

Not all level-funded plans handle refunds the same way. Some give you 50% of unused claims funds back, others give you more. Understand the formula before you sign up.

Step 5: Work with an Experienced Broker

Level-funded plans are more complex than traditional insurance. A broker who specializes in this area can help you avoid pitfalls and find the best fit for your business.

Why Choose Us?

At Wilkerson Insurance Agency, we help Texas small business owners find the right balance between cost savings and risk protection.

- 15+ Years of Experience: We’ve helped businesses across Dallas, Plano, Irving, and surrounding areas evaluate and implement level-funded plans

- Personalized Service: We’ll analyze your current costs, workforce demographics, and risk tolerance to recommend the best option

- Deep Knowledge: Our team understands the differences between fully-insured, level-funded, and ICHRA options—and when each makes sense

- Multiple Options: We work with UnitedHealthcare, BCBS of Texas, Texicare, Cigna, Aetna, and other carriers to get you competitive quotes

- Ongoing Support: We monitor your plan throughout the year and help you make adjustments at renewal

- Free Consultations: Meet with us to explore whether level-funded insurance could save your business money

Frequently Asked Questions

Is level-funded insurance risky for small businesses?

There’s more variability than fully-insured plans, but stop-loss insurance limits your downside. For healthy groups, the potential savings often outweigh the added complexity.

Can I switch from a fully-insured plan to level-funded mid-year?

Generally, you’d switch at your renewal date. Some carriers may allow mid-year changes, but it’s usually cleaner to plan for renewal.

What if one employee has a major health event?

That’s what specific stop-loss insurance is for. If any single employee’s claims exceed the threshold (often $25,000-$50,000), stop-loss kicks in to cover the excess.

Do level-funded plans have the same networks as regular insurance?

Yes, level-funded plans from major carriers use the same provider networks as their fully-insured options. Your employees can see the same doctors and hospitals.

How much can I really save with level-funded insurance?

It varies by group, but healthy businesses often save 10-20% compared to fully-insured plans plus the potential for year-end refunds on unused claims funds.

Conclusion

Level-funded health plans offer Texas small businesses a middle ground between traditional insurance and full self-funding. You get predictable monthly costs, protection from catastrophic claims, and the chance to share in savings when your team stays healthy.

It’s not the right fit for every business but for healthy groups in the 10-50 employee range, level-funded plans can deliver real value.

Want to see if level-funding could work for your company? Contact Wilkerson Insurance Agency today. We’ll run the numbers and help you make an informed decision.