You might be feeling a bit stressed right now. After all, the January 15th deadline for open enrollment in Texas has passed, and you’re probably wondering what to do next. It’s completely understandable to be concerned, but rest assured, missing that deadline doesn’t mean you’re out of options. There are still ways to secure health coverage, and that’s exactly what we’re here to guide you through.

At Wilkerson Insurance Agency, we’ve been helping individuals and families in the Farmers Branch and Dallas areas for over 15 years. Our team understands how overwhelming the health insurance process can be, especially when you’ve missed the open enrollment period. We’re independent agents, meaning we’re able to offer unbiased advice, and we’ll walk you through all the paths available to you.

Key Takeaways

- Special Enrollment Period: How you can apply for health coverage after missing the open enrollment deadline.

- Qualifying Life Events: The life changes that make you eligible for an SEP.

- Medicaid & CHIP: Whether you qualify for these programs in Texas.

- Short-Term Health Insurance: What these options are and how they compare to ACA plans.

- COBRA: Understanding your job-based coverage continuation rights.

- Risks of Being Uninsured: Why staying without insurance can cost you more in the long run.

So, take a deep breath. Let’s explore your options and get you covered as soon as possible.

Can You Still Get Health Insurance After Missing Open Enrollment in Texas?

You may already be wondering if it’s too late to get health insurance in Texas now that open enrollment has closed. The good news is, you still have options to secure coverage.

In Texas, missing the January 15th deadline for open enrollment doesn’t mean you’re left without health insurance. There are specific situations that allow you to apply for coverage outside of the regular enrollment period. These are called Special Enrollment Periods (SEPs), and they’re triggered by certain life events.

If you qualify for an SEP, you can apply for health insurance coverage through the Affordable Care Act (ACA) marketplace at any time during your 60-day window after a qualifying life event (QLE). Alternatively, you might be eligible for Medicaid or short-term health insurance plans.

Quick Self-Check: Do You Have a Recent Life Change?

It’s completely natural to be uncertain about your eligibility for a Special Enrollment Period (SEP). Major life changes like losing a job, getting married, having a baby, or relocating can all trigger a new enrollment window. To help you quickly determine if you’re eligible, here’s a simple checklist:

- Did you lose your job-based health coverage?

- Did you get married or divorced?

- Did you have a baby or adopt a child?

- Did you move to a new location?

- Did you experience a change in income?

If you answered “yes” to any of these questions, you could qualify for an SEP and can apply for coverage right away. For a deeper look at how these events reshape your coverage options, see our guide on how major life changes affect your family health insurance options.

Do You Qualify for a Special Enrollment Period in Texas?

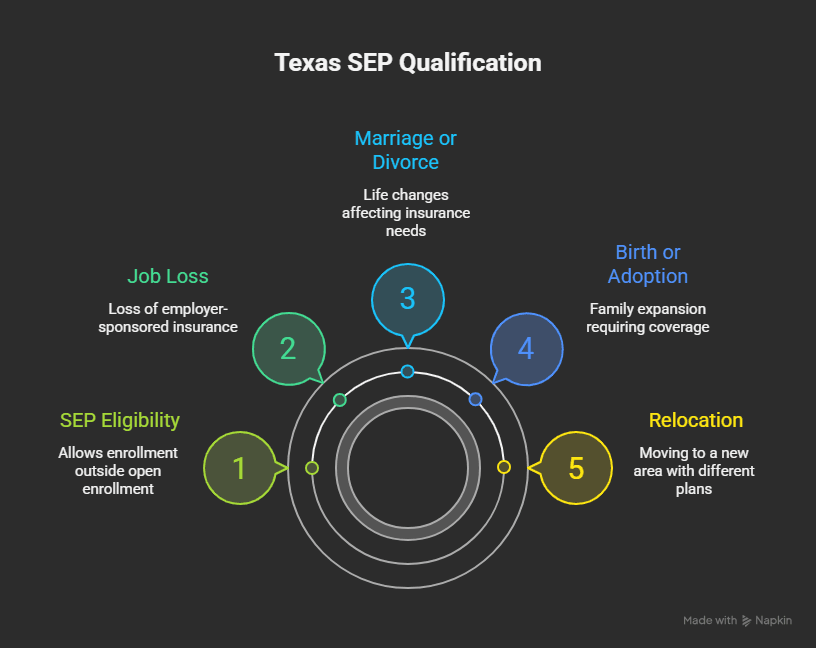

At this point, it’s completely natural if you have a few questions about what triggers a Special Enrollment Period (SEP) and how you can apply for it.

In Texas, there are several events that can qualify you for an SEP. Some of the most common are:

- Job Loss: If you lost your employer-sponsored health insurance, you could be eligible for an SEP.

- Marriage or Divorce: Marriage and divorce are also life events that can trigger an SEP.

- Birth or Adoption: If you’ve recently had a child or adopted one, you may qualify.

- Relocation: Moving to a new area where your current coverage isn’t available could qualify you for an SEP.

To apply for an SEP, you’ll need to provide proof of the qualifying life event (QLE). This could include a job termination letter, a marriage certificate, or proof of a birth or adoption.

Most Common Qualifying Life Events for Texans

| QLE | Example | Proof Needed | |

| Loss of Coverage | Lost job-based coverage | Job loss letter, unemployment benefits | |

| Marriage or Divorce | Recently married or divorced | Marriage certificate, divorce decree | |

| Birth or Adoption | Gave birth or adopted a child | Birth certificate, adoption papers | |

| Moving | Moved to a new county or state | Proof of new address |

How Do You Apply for a Special Enrollment Period on Healthcare.gov?

If you’re unsure how to apply for an SEP, don’t worry we’ve got you covered.

Applying for an SEP is easy if you follow these simple steps. The official HealthCare.gov Special Enrollment Period page walks through every qualifying event and what documents you’ll need it’s worth bookmarking before you start your application.

- Visit Healthcare.gov: Go to the official Marketplace site.

- Create an Account: If you don’t already have one, set up an account.

- Select Special Enrollment Period: Follow the prompts to indicate that you’re applying for coverage outside of the open enrollment period.

- Upload Proof Documents: Provide the necessary documentation for your qualifying life event.

- Choose Your Plan: Select the plan that fits your needs.

The entire process can take anywhere from a few days to a couple of weeks, depending on your circumstances. Just be sure to act quickly before your 60-day window closes.

Are You Eligible for Medicaid or CHIP in Texas Right Now?

At this point, you might be wondering if you’re eligible for Medicaid or CHIP in Texas. Medicaid is a program for low-income individuals and families, while CHIP provides health coverage for children in families that earn too much for Medicaid but can’t afford private insurance.

In Texas, Medicaid has not been expanded, meaning eligibility is still quite restrictive. To qualify for Medicaid, you typically need to meet certain income guidelines. CHIP, on the other hand, is more flexible and is available for children up to age 19 in low-income families.

To check your eligibility for Medicaid or CHIP, visit the Texas Health and Human Services Medicaid and CHIP page; it includes income guidelines, program details, and a direct link to apply online.

What Short-Term Health Insurance Options Exist in Texas?

Short-term health insurance might be a good option if you need coverage for a short period of time. These plans are designed to bridge the gap between when your previous coverage ends and when new coverage begins. However, there are limits on how long you can stay covered with short-term plans in Texas, usually 3 to 4 months at a time.

Before signing up, it’s important to understand that short-term health insurance does not meet the ACA’s coverage requirements. These plans are typically much cheaper than ACA plans, but they don’t cover essential health benefits like mental health, maternity care, or prescription drugs.

If you’re weighing short-term plans against other alternatives, our article on exploring alternative individual health insurance options breaks down the full landscape of choices available outside the marketplace. You can also visit our Individual & Family Health Insurance Plans page for expert guidance on finding the best option for you.

Are Health Care Sharing Ministries a Viable Alternative in Texas?

Health care sharing ministries are an alternative to traditional health insurance. These programs allow members to share medical costs, but it’s important to know that these are not traditional insurance plans.

In Texas, health care sharing ministries operate under different rules than insurance companies. While some people find them to be a viable option, they are not guaranteed to cover all your health expenses, and they may not be able to protect you from unexpected medical costs.

What If You Recently Lost Job-Based Coverage? (COBRA Explained)

If you’ve lost your job-based health insurance, you may qualify for COBRA continuation coverage. COBRA allows you to keep your previous health insurance plan for a limited time typically 18 to 36 months after your job ends.

However, there’s a catch: while COBRA lets you keep your coverage, you’ll have to pay the full premium, including what your employer used to cover. This can be expensive, so it’s important to carefully consider whether COBRA is the right choice for you.

What Are the Risks of Staying Uninsured in Texas?

In Texas, the consequences of being uninsured are significant. Not only are you at risk for huge medical bills if an emergency arises, but Texas has the highest uninsured rate in the country around 16–18%, with more than 5 million people lacking health coverage.

If you’re uninsured, you’re also more likely to delay needed medical care, which can lead to worse health outcomes in the long run. Our in-depth post on the hidden costs of skipping health insurance coverage shows exactly what financial exposure looks like for uninsured Texans — the numbers may surprise you.

Next Open Enrollment Period in Texas?

Looking ahead, you might be wondering when you can sign up for health insurance again. The next open enrollment period for 2027 coverage will run from November 1, 2026, to January 15, 2027. This is the time to review your options and secure coverage for the upcoming year.

Which Coverage Option Is Right for Your Situation?

There are many coverage options available to you, but how do you know which one is right? Here’s a quick comparison of some common options:

| Option | Duration | Cost Range | Pros | Cons |

| ACA Marketplace Plans | 12 months | Varies | Comprehensive coverage | Premiums and deductibles can be high |

| Short-Term Insurance | 3–4 months | Low | Lower premiums | Limited coverage, not ACA-compliant |

| Medicaid/CHIP | Ongoing | Free or low-cost | Available for low-income families | Income limits apply |

If you’re unsure which plan type fits your family, our breakdown of HMO vs. PPO vs. EPO vs. POS plans can help clarify the differences before you make a decision.

Why Choose Wilkerson Insurance Agency?

At Wilkerson Insurance Agency, we’re not just another insurance provider – we’re a local, trusted partner who genuinely cares about your health coverage needs. With over 15 years of experience serving Farmers Branch and the Dallas area, our dedicated team is committed to helping you navigate the complex world of health insurance with ease. Here’s why you should choose us:

- Independent & Unbiased Advice: As an independent agency, we work with multiple top insurance carriers to find you the best coverage at the most competitive prices, no bias, no pressure.

- Over 15 Years of Local Experience: We’ve been serving families in the Farmers Branch/Dallas area for more than 15 years, so we understand the local health care landscape and can provide expert guidance tailored to your needs.

- Personalized Service: We take the time to listen to your unique situation and offer custom solutions that fit your health and financial needs. Our agents are here for you every step of the way.

- Free Year-Round Support: Whether you’re navigating a life change or need help with claims, we provide continuous support all at no additional cost to you.

- Licensed & Highly Rated Agents: Our agents are licensed and highly knowledgeable in Texas health insurance policies. With 2,000+ happy clients, our reputation speaks for itself.

- Wide Range of Coverage Options: We help you explore every option from ACA marketplace plans to short-term insurance and even Medicaid eligibility ensuring you find the right fit.

Choose Wilkerson Insurance Agency for a smooth, transparent, and stress-free experience in securing the right health insurance for you and your family. Let us help you find the coverage that fits your needs. Contact us today!

Frequently Asked Questions

What is the Special Enrollment Period (SEP)?

The Special Enrollment Period (SEP) allows you to apply for health coverage outside of the regular open enrollment period if you’ve experienced a qualifying life event, such as job loss, marriage, or the birth of a child.

How do I apply for an SEP in Texas?

To apply for an SEP in Texas, visit Healthcare.gov, create an account, select the SEP option, and provide proof of your qualifying life event. The application process typically takes a few days to a couple of weeks.

Am I eligible for Medicaid in Texas?

Medicaid eligibility in Texas depends on your income and household size. Since Texas has not expanded Medicaid, eligibility is limited, and the income threshold must meet specific state guidelines.

What are the risks of staying uninsured in Texas?

Staying uninsured in Texas can lead to significant financial strain if you experience a medical emergency. Texas has the highest uninsured rate in the country, and the lack of coverage can result in high medical bills and delayed care.

Can I get COBRA after losing my job-based coverage?

Yes, COBRA allows you to continue your employer-based health insurance coverage for a limited time after job loss. However, you must pay the full premium cost, which can be expensive.

Conclusion

If you’ve missed open enrollment, don’t worry. There are still several ways you can secure health insurance coverage in Texas. Whether it’s through a Special Enrollment Period, Medicaid, or short-term health insurance, our team at Wilkerson Insurance Agency is here to help you explore your options. We’ve helped thousands of families in the Dallas area find the right coverage and we can do the same for you.

Take the first step today by scheduling a free consultation to discuss your needs and find the best solution for your situation.