Did your health insurance company say no to your claim? That can be really frustrating. But here is the good news: you are not alone, and most denied claims can be reversed.

Many people in Farmers Branch, Dallas, Carrollton, Addison, and Irving face this same problem. This guide will show you exactly how to fight back and get your claim approved.

We will walk you through each step, from reading your denial letter to writing your appeal. By the end, you will know exactly what to do.

What You Will Learn from This Guide

- Why your claim was denied and how to read your benefits letter

- Step-by-step instructions to appeal a denied claim

- The most common reasons claims get denied and how to fix them

- Mistakes to avoid during the appeal process

- Deadlines you need to know for Texas appeals

- How to gather the right documents for your case

What is a Health Insurance Claim?

A health insurance claim is a request you send to your insurance company. You are asking them to pay for medical care you received. This includes doctor visits, hospital stays, medicines, and surgeries.

When you get care, your doctor or hospital sends the claim to your insurer. The insurance company then decides how much they will pay based on your plan.

For people living in Farmers Branch, Carrollton, Richardson, Plano, and the greater Dallas-Fort Worth area, knowing how claims work is extra helpful. Here is why:

- High Denial Rates: In Texas, about 1 in 5 health insurance claims are denied at first. But most of these can be overturned with the right appeal.

- Many Health Plan Types: People here have many different types of health plans. Knowing how your specific plan handles claims helps you avoid surprise costs.

- Big Healthcare Network: The DFW area has many specialists and hospitals. Sometimes you might see a provider who is not in your network. Knowing how this affects your claims is helpful.

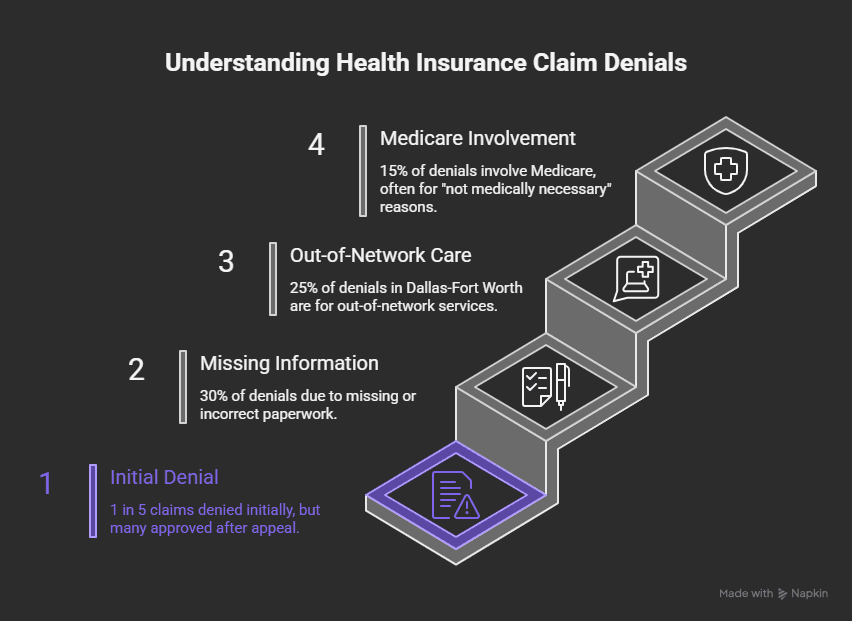

Health Insurance Claim Denials: The Numbers You Should Know

Here are some facts about claim denials in the Dallas-Fort Worth area that might surprise you:

- 1 in 5 health insurance claims are denied at first in Texas. But most are approved after an appeal.

- 30% of denials happen because of missing or wrong information. This is often just a simple mistake on a form.

- 25% of denied claims in Dallas are for out-of-network care. Many people see specialists who are not in their plan.

- 15% of denied claims in Texas are Medicare claims. The main reason? The insurer says the treatment was not medically necessary.

These numbers show that claim denials are common. But they also show that many denials can be fixed. You just need to know the right steps.

What Does a Denied Health Insurance Claim Mean?

When your insurer says no to your claim, it is helpful to know exactly what that means. There are different types of problems that can happen:

Denied vs. Rejected vs. Delayed Claims

- Denied: The insurer looked at your claim and decided not to pay. They will give you specific reasons in your Explanation of Benefits (EOB) letter.

- Rejected: The insurer never processed your claim. This usually happens because of wrong information or mistakes on the form.

- Delayed: Your claim is still being reviewed. The insurer needs more information or more time to decide.

Common Reasons Health Insurance Claims Get Denied

Claims can be denied for many reasons. Some you can prevent, and some you can fix after they happen. Here are the most common ones:

| Reason | What It Means |

| Missing or Wrong Information | Your name, policy number, or service details have errors. |

| Out-of-Network Provider | Your doctor or hospital is not part of your insurance plan’s network. |

| No Preauthorization | You did not get approval before having a treatment that required it. |

| Not Medically Necessary | The insurer does not think you needed the treatment. |

| Coding or Billing Errors | The doctor’s office used the wrong codes when filing the claim. |

Step One: Read Your Explanation of Benefits (EOB) Carefully

Your Explanation of Benefits (EOB) is a letter from your insurer. It tells you why your claim was denied. You need to read this carefully before you do anything else.

Here is what to look for in your EOB:

| Section | What to Check |

| Claim Number | This is the reference number for your claim. You will need this for your appeal. |

| Service Date | Make sure this date matches when you got care. |

| Amount Billed | The total amount your doctor or hospital charged. |

| Amount Covered | How much the insurer agreed to pay. |

| Amount Denied | The part of the bill the insurer said no to. |

Your EOB will also have denial codes. Here are two common ones:

- CO-16: The claim is missing information or documents.

- PR-8: The service is not covered by your plan.

Step Two: Check That Your Claim Was Filed Right

Before you start the appeal, make sure the claim was filed correctly. Simple mistakes can cause denials. Here is what to check:

| What to Check | Why It Matters |

| Your Name and Date of Birth | Even small typos can cause a denial. |

| Your Policy Number | Make sure it matches your insurance card exactly. |

| Treatment Codes | The doctor’s office needs to use the correct billing codes. |

If you find a mistake, contact your doctor’s billing office. They can fix the error and resubmit the claim. You might not even need to file an appeal.

Step Three: Know Your Policy and Your Rights

Take time to read your insurance policy. You need to know what your plan covers and how the appeal process works.

Look for these things in your policy:

- Appeal Rights: Find the section that explains how to appeal a denied claim.

- ACA Protections: Under the Affordable Care Act, you have the right to appeal any denial. Your insurer must tell you how.

If you live in Farmers Branch, Carrollton, Irving, or anywhere in Texas, you also have state protections. Texas law gives you extra time and options for appeals in some cases.

Step Four: Know Your Deadlines

Deadlines matter a lot in the appeal process. If you miss a deadline, you might lose your chance to appeal. Here is what you need to know:

| Type of Appeal | How Much Time You Have |

| Internal Appeal | 30 to 180 days, depending on your insurer |

| External Review | 30 to 45 days after your internal appeal is denied |

| Texas State Rules | Texas residents may have extra time under state law |

Mark these dates on your calendar. Do not wait until the last day to file.

Step Five: Gather Your Documents

A strong appeal needs strong evidence. Gather these documents before you write your appeal letter:

- Medical Records: Get detailed records from your doctor about your treatment.

- Letter of Medical Necessity: Ask your doctor to write a letter explaining why you needed the treatment.

- Prior Authorization Proof: If your treatment needed approval first, get proof that you had it.

- Your EOB: Include a copy of the denial letter.

- Policy Documents: Show the part of your policy that supports your case.

Step Six: Write a Strong Appeal Letter

Your appeal letter is your chance to make your case. Keep it clear and to the point. Here is what to include:

- Your Policy Number and Claim Reference: This helps the insurer find your case quickly.

- The Reason for Your Appeal: Explain why you believe the claim should be paid.

- Supporting Evidence: List all the documents you are including.

- Policy Language: Quote the parts of your policy that support your case.

Be polite but firm. Stick to the facts and do not get emotional.

Step Seven: Submit Your Appeal the Right Way

Follow your insurer’s submission rules carefully. Here are your options:

- Mail: Send your appeal by certified mail. This gives you proof it was delivered.

- Online Portal: Some insurers let you submit appeals online. Print or save a confirmation.

- Fax: If you fax your appeal, keep the fax confirmation page.

Always keep copies of everything you send. You may need them later.

Why Choose Us: Why Wilkerson Insurance Agency

At Wilkerson Insurance Agency, we understand how challenging and confusing the claims process can be. Here’s why we’re the trusted choice for handling your denied health insurance claim:

- Personalized, Family-First Approach: We treat every client like family and offer year-round support, not just during open enrollment.

- Local Expertise: With over 15 years of experience in the Farmers Branch, Dallas and surrounding areas, we know the ins and outs of Texas health insurance claims.

- Independent Broker Support: We compare multiple carriers to find the best rate and plan for you, ensuring you’re always getting the best value.

- Proactive Advocacy: We don’t just submit paperwork, we advocate for your case with the insurer to make sure you get the coverage you deserve.

Frequently Asked Questions

Can I appeal a health insurance claim denial myself?

Yes, you can appeal on your own. But having an insurance broker or expert can make the process easier and faster.

How many times can I appeal a denied claim?

Usually, you can appeal twice. First, you file an internal appeal with your insurer. If that fails, you can ask for an external review by an outside party.

What are my rights under the Affordable Care Act?

The ACA gives you the right to appeal any claim denial. Your insurer must explain how to appeal and must treat you fairly.

Will appealing a claim affect my future coverage?

No. Insurers must make decisions based on your policy. They cannot punish you for filing an appeal.

How long does the insurance company have to respond?

Insurers must respond to internal appeals within 30 days. External reviews can take 30 to 45 days.

Can a broker help with denied claims after I have enrolled?

Yes. A broker can help you with denied claims at any time. They can advocate for you and help with the appeal.

Are Medicare claim appeals different from private insurance?

Yes. Medicare has its own rules, timelines, and processes. If you have Medicare, make sure you know your specific rights.

What if my claim was denied for medical necessity?

You will need extra documentation from your doctor. Ask them to write a detailed letter explaining why the treatment was medically needed.

Get Help with Your Denied Claim Today

Dealing with a denied health insurance claim does not have to be stressful. Let Wilkerson Insurance Agency guide you through the appeal process. With our local knowledge and personal support, we will help you get the coverage you deserve.

Ready to fight your denied claim? Contact Wilkerson Insurance Agency today. Our experts in Farmers Branch and the Dallas-Fort Worth area are here to help you win your appeal.