Are you trying to decide between a Health Savings Account (HSA) and a Flexible Spending Account (FSA) for 2026? You’re not alone! Both accounts offer valuable tax advantages, but they work in different ways, which can make the decision tricky.

In this guide, we’ll break down the key differences between HSAs and FSAs, including contribution limits, eligibility, tax benefits, and how unused funds are handled. By the end of this post, you’ll know which account is best for your health needs and financial goals in 2026.

By the end of this blog, you will learn:

- The key differences between HSAs and FSAs

- How contribution limits and eligibility work for each account

- The tax benefits of both HSAs and FSAs

- What happens to unused funds in each account

- Which account is better for short-term vs. long-term savings

Let’s dive into the details to help you make an informed decision for your healthcare savings in 2026. And if you’re still unsure, we’re here to help. Schedule a free consultation with us at Wilkerson Insurance Agency today!

What Is a Flexible Spending Account (FSA)?

You may already be wondering how a Flexible Spending Account (FSA) works. An FSA is a pre-tax account that allows you to set aside money for eligible medical expenses. The money is deducted from your paycheck and deposited into your FSA account, lowering your taxable income for the year. This means you pay fewer taxes upfront, which can help reduce your overall financial burden.

FSAs are offered through employers, so if your workplace provides this benefit, you can participate in this program. Contributions are typically limited to a certain amount each year, and the funds are available to use as soon as they are deposited into the account. The primary caveat is that FSAs operate on a “use it or lose it” rule meaning unused funds may not roll over into the next year.

For a complete breakdown of FSA rules including eligible expenses, grace period rules, and carryover details the IRS Publication 969: Health Savings Accounts and Other Tax-Favored Plans is the definitive official source for eligibility, contributions, and qualified expenses.

Last year, one of our clients used their FSA to cover the cost of dental work, including fillings and cleanings including through our dental insurance plans. By using their FSA funds, they reduced their taxable income and avoided the stress of paying out-of-pocket for unexpected expenses.

What Is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is a tax-advantaged account that works a little differently from an FSA. To qualify for an HSA, you must be enrolled in a High-Deductible Health Plan (HDHP). The advantage of an HSA is that it allows you to save money tax-free for future healthcare expenses. Not only are the contributions tax-deductible, but the funds also grow tax-free, and when you use them for qualified medical expenses, they come out tax-free as well; this is often referred to as the “triple tax advantage.”

To qualify for an HSA in 2026, your plan must meet the 2026 IRS HDHP requirements, which specify that the deductible must be at least $1,700 for self-only coverage or $3,400 for family coverage.

Unlike FSAs, HSAs don’t have a “use it or lose it” rule. The funds roll over from year to year, and you can even invest the money in your account for long-term growth, making it a great option if you’re thinking about saving for retirement healthcare costs. To explore our HSA plan options, visit our dedicated HSA plans page.

A family in Farmers Branch recently transitioned to an HDHP to qualify for an HSA. They contributed the maximum amount and invested their funds for growth, which will help them pay for healthcare costs well into retirement. This strategy allows them to build a solid foundation for future healthcare savings.

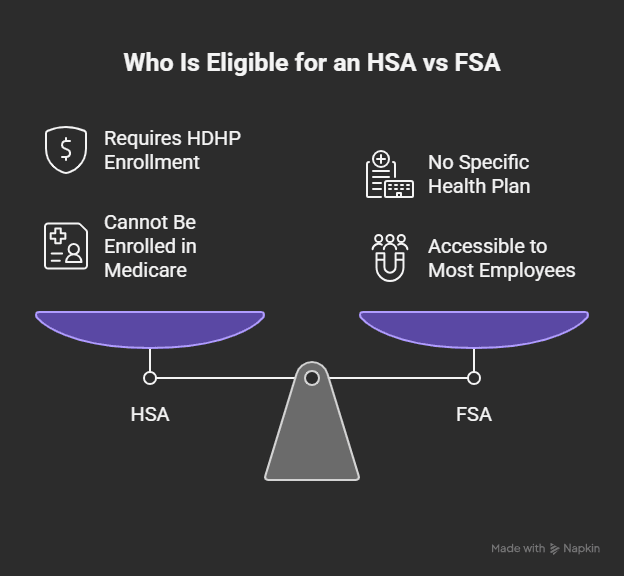

Who Is Eligible for an HSA vs FSA in 2026?

To open an HSA, you must be enrolled in a High-Deductible Health Plan (HDHP). The 2026 IRS guidelines define an HDHP as a plan with a minimum deductible of $1,700 for self-only coverage or $3,400 for family coverage. In addition to meeting these thresholds, HSAs are generally available to people who are not enrolled in other health coverage, like a traditional health plan or Medicare. For further clarification on HSA eligibility, HealthCare.gov’s official HSA guide is an excellent government resource that explains exactly which plan types now qualify for 2026.

FSAs, on the other hand, are available to most employees whose employer offers this benefit. You don’t need to have a specific type of health plan to qualify for an FSA, and it’s often easier to access through your employer’s benefits package.

A self-employed individual in Farmers Branch who has a high-deductible health insurance plan with a deductible of $2,000 is eligible for an HSA. However, a client who works for a company offering an FSA would not need an HDHP to contribute to an FSA. If you’re self-employed and navigating coverage on your own, our guide to individual and family health insurance in Texas covers your options in detail.

What Are the 2026 Contribution Limits for HSA vs FSA?

If you’re wondering how much you can contribute to your HSA or FSA in 2026, here’s the breakdown.

For 2026, the contribution limits are as follows:

- HSA: You can contribute up to $4,400 if you’re single and $8,750 for families. If you’re 55 or older, you can also make a catch-up contribution of $1,000.

- FSA: The maximum contribution for an FSA is $3,400, with a $680 carryover option for unused funds.

For further details on 2026 contribution limits, refer to the IRS’s official guidance.

A client with a family HDHP enrolled in an HSA this year took full advantage of the $8,750 contribution limit. This allowed them to cover their medical costs and save for the future. To understand every angle of how HSAs can benefit your family, see our full breakdown of why an HSA is a game-changer for families planning to grow.

What Happens to Unused Funds in an HSA vs FSA?

For an FSA, the “use it or lose it” rule applies. If you don’t use your funds by the end of the year (or any applicable grace period), you’ll lose them. However, some employers offer a limited carryover option, allowing you to roll over up to $680 the next year.

With an HSA, unused funds roll over year after year, giving you more flexibility and the ability to accumulate savings for future healthcare expenses. This feature makes an HSA an ideal option if you want to plan for healthcare costs in retirement.

For more details, you can refer to the IRS list of qualified medical expenses to understand what expenses are eligible.

A family in Farmers Branch used their FSA to pay for dental work early in the year but didn’t use the full amount by the end of the year. Because their employer offered the $680 carryover, they were able to keep a small portion for the following year. On the other hand, their HSA balance rolled over untouched, giving them a cushion for future expenses.

Can HSA Funds Be Invested, Unlike FSA?

You’re probably wondering if you can grow your HSA funds over time. The answer is yes! Unlike an FSA, HSA funds can be invested in a variety of options such as stocks, bonds, or mutual funds, allowing your savings to grow tax-free. This is a major advantage for those looking to build long-term savings for healthcare costs in retirement.

We’ve recently helped clients invest their HSA funds for long-term growth. One of them was able to grow their HSA balance significantly over five years by choosing the right investments. For a step-by-step look at making the most of this strategy, our post on how to maximize your HSA for healthcare expenses and retirement is an excellent starting point.

How Do Tax Benefits and Access Compare?

Both FSAs and HSAs offer tax savings, but they do so in different ways. With an FSA, your contributions are deducted from your paycheck before taxes, lowering your taxable income. However, once you’ve spent the funds, that’s the end of the line for that year.

With an HSA, you get the triple tax advantage: your contributions are tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are tax-free. Our post on the triple tax advantage and the hidden financial benefits of HSA plans explains exactly how this can add up to thousands in savings over time.

A couple in Farmers Branch contributed to their HSA for the year and saved on their taxes. After investing their funds, they’re now enjoying tax-free growth and preparing for future healthcare costs.

Can You Have Both an HSA and FSA at the Same Time?

You might be wondering if it’s possible to contribute to both an HSA and an FSA at the same time. The answer is yes, but with some conditions.

You can have both accounts if your employer offers them and you are enrolled in a High-Deductible Health Plan (HDHP). However, there are limits to how much you can contribute to each account. FSAs are often used in combination with HSAs for specific needs, such as dental and vision expenses, which are covered by an FSA but not by an HSA.

A client who has both an HSA and an FSA uses the FSA for dental and vision insurance expenses, while their HSA funds are saved for larger medical expenses or retirement healthcare. For a full comparison of the flexibility and benefits each account provides, see our breakdown of why HSAs are more flexible than FSAs.

HSA vs FSA: Side-by-Side Comparison Table

Here’s a quick comparison of the key differences between an HSA and an FSA:

| Feature | HSA | FSA |

| Eligibility | Must have an HDHP | Available to most employees |

| Contribution Limits | $4,400 (self), $8,750 (family); catch-up $1,000 | $3,400; carryover of $680 |

| Fund Roll Over | Yes | No (except for carryover) |

| Investment Options | Yes | No |

| Tax Benefits | Triple tax advantage | Pre-tax payroll deductions |

| Account Ownership | You own the account | Employer-owned |

Which Account Is Right for You: HSA or FSA?

Not sure which account is best for you? Let’s break it down.

- HSA: Best for those who want to save long-term for healthcare expenses, especially those looking to build savings for retirement. If you’re eligible for an HDHP, an HSA is an excellent option.

- FSA: Ideal for those looking to cover short-term healthcare expenses without worrying about tax liabilities. Great for dental, vision, and out-of-pocket medical costs that can be paid for immediately.

A family looking to save for future healthcare costs in retirement should choose an HSA, while a person with regular, small medical costs may benefit more from an FSA. Still on the fence? Our comprehensive guide to the hidden benefits of HSAs and tax-smart medical savings can help you decide with confidence.

Why Choose Wilkerson Insurance Agency for Health Plan Guidance?

At this point, you might be wondering, “Why should I choose Wilkerson Insurance Agency to help me with my health plan decision?” Here’s why:

- Personalized Plan Reviews: We tailor each review to your unique Texas family or business needs, ensuring you get the best fit for your healthcare goals.

- Local Expertise: With decades of experience serving Farmers Branch and North Texas, we understand the community’s healthcare needs like no one else.

- Independent Access to Multiple Carriers: As an independent agency, we have access to multiple insurance carriers, allowing us to provide unbiased options that best suit your needs.

- Free, No-Obligation Consultations: Our consultations are completely free and come with no obligation. You’ll receive clear, straightforward answers to your questions.

- Proven Track Record: We have a long history of helping clients maximize their tax savings and healthcare coverage, ensuring they get the most out of their plans.

We focus on what’s best for you whether it’s an HSA, an FSA, or another health plan option. We take the time to understand your healthcare needs and financial goals, guiding you through the decision-making process with personalized, expert advice.

Frequently Asked Questions

Can I contribute to both an HSA and an FSA?

Yes, you can contribute to both an HSA and an FSA, but under certain conditions. If you have a High-Deductible Health Plan (HDHP), you can open an HSA. You can also contribute to a Limited Purpose FSA, which covers dental and vision expenses while still maintaining your HSA.

What happens if I don’t use all my FSA funds?

For most FSAs, unused funds are lost at the end of the year, following the “use it or lose it” rule. However, some employers offer a carryover option for up to $680 or a grace period to spend the remaining funds.

Can I use HSA funds for non-medical expenses?

Yes, you can use your HSA funds for non-medical expenses, but if you do, the withdrawal will be subject to income tax and a 20% penalty before age 65. After age 65, non-medical withdrawals are taxed as income, but the penalty is waived.

Can I use an HSA for family members?

Yes, HSA funds can be used for your spouse, dependents, and even children up to age 26, as long as they are eligible for medical expenses under IRS rules.

What is the catch-up contribution for an HSA in 2026?

For 2026, individuals 55 years or older can contribute an additional $1,000 to their HSA, on top of the standard contribution limits of $4,400 for individuals and $8,750 for families.

Conclusion

Choosing between an HSA and an FSA depends on your healthcare needs, financial goals, and eligibility. While an HSA is perfect for long-term savings and tax-free growth, an FSA offers immediate tax savings for short-term expenses. No matter what you decide, Wilkerson Insurance Agency in Farmers Branch is here to guide you through the process.

Schedule a free consultation today and let us help you choose the right plan for you.