If you’re turning 65 or recently enrolled in Medicare, you’ve probably heard about Medigap plans. These Medicare Supplement policies help cover the out-of-pocket costs that Original Medicare leaves behind things like deductibles, coinsurance, and copays.

Two of the most popular Medigap plans in Texas are Plan G and Plan N. Both offer solid coverage, but they work differently and cost different amounts.

So which one saves you more money? Let’s compare them side by side.

What Medicare Supplement Insurance Does

Original Medicare (Part A and Part B) covers a lot but not everything. You’re still responsible for:

- The Part A deductible ($1,676 in 2025) for hospital stays

- The Part B deductible ($257 in 2025) for doctor visits and outpatient care

- 20% coinsurance for most Part B services

- Skilled nursing facility coinsurance

- Part B excess charges (if a doctor charges more than Medicare allows)

These gaps can add up fast. A single hospital stay could cost you thousands out of pocket.

Medigap policies fill these gaps. You pay a monthly premium, and in return, the insurance company covers some or all of your cost-sharing. For a deeper understanding, read our guide on understanding Medigap and how these plans fill costly gaps in Medicare.

Plan G: The Most Popular Choice

Plan G is the most popular Medicare Supplement plan in Texas—and nationwide. It’s often called the “gold standard” because it covers almost everything.

What Plan G Covers:

- Part A hospital deductible ($1,676 in 2025) ✓

- Part A hospital coinsurance and costs ✓

- Part B coinsurance (typically 20% of costs) ✓

- Blood (first 3 pints) ✓

- Skilled nursing facility coinsurance ✓

- Part B excess charges ✓

- Foreign travel emergency (80% coverage) ✓

What Plan G Doesn’t Cover:

- Part B deductible ($257 in 2025)

That’s it. The only out-of-pocket cost with Plan G is the $257 annual Part B deductible. After you meet that, Plan G picks up the rest.

Plan G Costs in Texas:

Monthly premiums for Plan G in Texas typically range from $130 to $250 per month, depending on your age, gender, location, and insurance company. The average is around $165-180/month for a 65-year-old.

Plan N: The Budget-Friendly Alternative

Plan N offers nearly the same coverage as Plan G, but with a few trade-offs that lower your monthly premium.

What Plan N Covers:

- Part A hospital deductible ($1,676 in 2025) ✓

- Part A hospital coinsurance and costs ✓

- Part B coinsurance (with small copays) ✓

- Blood (first 3 pints) ✓

- Skilled nursing facility coinsurance ✓

- Foreign travel emergency (80% coverage) ✓

What Plan N Doesn’t Cover:

- Part B deductible ($257 in 2025)

- Part B excess charges

- Plan N requires copays up to $20 for doctor visits and up to $50 for ER visits that don’t result in hospital admission

Plan N Costs in Texas:

Monthly premiums for Plan N in Texas typically range from $95 to $175 per month. The average is around $110-130/month for a 65-year-old.

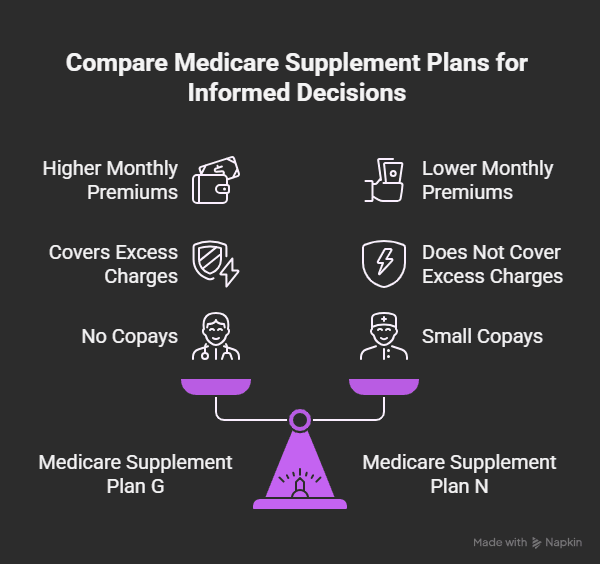

Plan G vs Plan N: Breaking Down the Differences

Let’s look at the three key differences:

Difference 1: Monthly Premiums

Plan N premiums are typically $30-50/month less than Plan G. That’s $360-600 per year in premium savings.

Difference 2: Part B Excess Charges

Plan G covers Part B excess charges; Plan N does not.

What are excess charges? When a doctor doesn’t accept Medicare “assignment,” they can charge up to 15% more than Medicare’s approved amount. You’d be responsible for that extra 15%.

Here’s the good news for Texans: excess charges are rare. Most doctors accept Medicare assignments and don’t charge extra. In states like Connecticut, Massachusetts, Minnesota, New York, Ohio, Pennsylvania, Rhode Island, and Vermont, excess charges are banned entirely. Texas doesn’t ban them, but they’re still uncommon.

Difference 3: Copays

Plan G has no copays. Plan N has small copays:

- Up to $20 for doctor’s office visits

- Up to $50 for ER visits that don’t lead to hospital admission

Many people in good health might visit the doctor 4-6 times per year, resulting in $80-120 in copays.

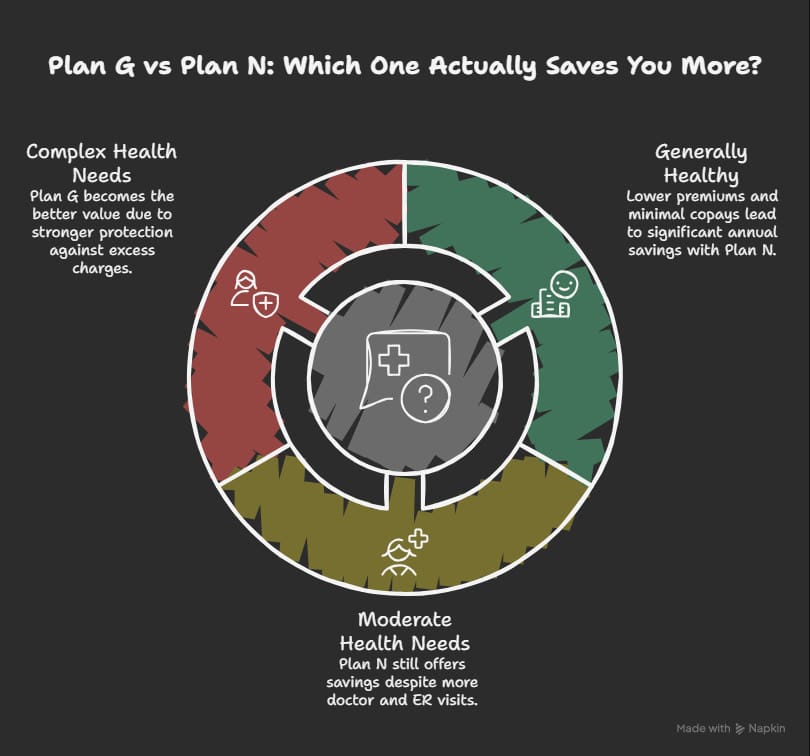

The Math: Which Plan Actually Saves You More?

Let’s run the numbers for a 65-year-old in Dallas, Texas:

Scenario 1: You’re Generally Healthy (Few Doctor Visits)

- Plan G premium: $170/month = $2,040/year

- Plan N premium: $120/month = $1,440/year

- Plan N copays: 4 doctor visits x $20 = $80

Plan G Total Cost: $2,040 Plan N Total Cost: $1,520 Plan N Saves: $520/year

Scenario 2: You Have Moderate Health Needs

- Plan G premium: $170/month = $2,040/year

- Plan N premium: $120/month = $1,440/year

- Plan N copays: 10 doctor visits x $20 = $200

- 1 ER visit (no admission): $50

Plan G Total Cost: $2,040 Plan N Total Cost: $1,690 Plan N Saves: $350/year

Scenario 3: You Have Complex Health Needs (Many Visits)

- Plan G premium: $170/month = $2,040/year

- Plan N premium: $120/month = $1,440/year

- Plan N copays: 20 doctor visits x $20 = $400

- 2 ER visits (no admission): $100

- 1 excess charge bill: $150 (15% of a $1,000 procedure)

Plan G Total Cost: $2,040 Plan N Total Cost: $2,090 Plan G Saves: $50/year

As you can see, Plan N saves money for most people but the savings shrink (or disappear) if you have lots of doctor visits or run into excess charges.

Who Should Choose Plan G?

Plan G makes more sense if:

- You have ongoing or chronic health conditions requiring frequent doctor visits

- You want zero surprises and maximum predictability

- You see specialists who might not accept Medicare assignment

- You prefer the “set it and forget it” approach

- Peace of mind is worth the extra $30-50/month to you

With Plan G, once you pay that $257 Part B deductible, you’re done. No copays, no excess charges, no additional bills for Medicare-covered services.

Our article on Medigap demystified: how it reduces financial stress from medical costs goes deeper into why many retirees prefer this peace of mind.

Who Should Choose Plan N?

Plan N makes more sense if:

- You’re relatively healthy and don’t see the doctor often

- You want to save $300-600 per year on premiums

- You’re comfortable with small copays at doctor visits

- Your doctors accept Medicare assignment (most do)

- You want good coverage at a lower price point

Plan N is often recommended for younger, healthier Medicare beneficiaries who don’t expect to use a lot of healthcare services.

What About High Deductible Plan G?

There’s also a High Deductible Plan G (HD Plan G) option. With this plan:

- You pay a much lower monthly premium (often $40-70/month)

- But you must meet a $2,870 deductible (in 2025) before the plan pays anything

- After the deductible, you get the same coverage as regular Plan G

HD Plan G appeals to:

- Very healthy people who want catastrophic protection

- Those who are comfortable managing out-of-pocket costs

- People transitioning from high-deductible employer plans

For most people, though, standard Plan G or Plan N is a better fit. Understanding how your age affects Medicare Supplement premiums can help you plan for long-term costs.

Important: Medigap Plans Are Standardized

Here’s something many Texans don’t realize: every Plan G is the same, and every Plan N is the same no matter which insurance company sells it.

By law, Medigap plans are standardized. A Plan G from Blue Cross Blue Shield offers the exact same benefits as a Plan G from Mutual of Omaha, Cigna, Aetna, or any other carrier.

The only differences between companies are:

- Premium prices (can vary significantly)

- Rate increase history (some companies raise rates more than others)

- Customer service quality

- Household or other discounts

That’s why shopping around matters. You can get the same coverage for less money just by comparing carriers.

Top Medigap Carriers in Texas

Here are some of the most popular Medicare Supplement insurance companies in Texas:

- Blue Cross Blue Shield of Texas: Strong reputation, broad acceptance

- Cigna/HealthSpring: Competitive rates, especially for Plan N

- Mutual of Omaha: Long track record, household discounts available

- Aetna: Good pricing for healthy applicants

- UnitedHealthcare/AARP: Name recognition, nationwide network

- State Farm: Loyal customer base, local agent support

- Humana: Competitive Plan G rates, wellness discounts

Premiums from these carriers can differ by $50/month or more for the same coverage. Always compare. You can learn more about Medicare Supplement plans in 2025 and what’s changing.

Why Choose Us?

At Wilkerson Insurance Agency, we help Texans find the right Medicare Supplement coverage at the best price.

- 15+ Years of Experience: We’ve helped thousands of Medicare beneficiaries across Dallas and surrounding areas choose between Plan G, Plan N, and other options

- Personalized Service: We take time to understand your health situation, budget, and preferences before recommending a plan

- Deep Knowledge: Our team stays current on Medicare rules, carrier pricing, and market changes

- Multiple Options: We work with all the major Medigap carriers, so we can show you quotes from across the market

- Ongoing Support: We’re here year-round to answer questions, help with claims, and review your coverage as your needs change

- Free Consultations: There’s no cost to meet with us and compare your options

If you’re also considering adding dental and vision coverage to your Medicare plan, check out our guide on the benefits of adding vision and dental to your Medicare plan.

Frequently Asked Questions

Can I switch from Plan G to Plan N (or vice versa)?

You can apply to switch Medigap plans at any time, but outside of your initial enrollment period, you may face medical underwriting. The insurance company can ask health questions and potentially deny coverage or charge higher rates based on pre-existing conditions.

Does Plan G or Plan N include prescription drug coverage?

No. Medigap plans don’t cover prescription drugs. You’ll need a separate Part D plan for medications.

Which plan has better networks?

Both Plan G and Plan N work with Original Medicare, so there are no networks. You can see any doctor or specialist in the country who accepts Medicare—no referrals needed.

Will my premiums go up over time?

Yes, Medigap premiums typically increase as you age and due to medical inflation. How fast they increase depends on the insurance company’s pricing method (attained-age, issue-age, or community-rated).

When is the best time to buy a Medigap plan?

During your 6-month Medigap Open Enrollment Period, which starts when you’re 65 AND enrolled in Part B. During this window, insurance companies cannot deny you coverage or charge higher premiums based on health conditions. You can learn more at Medicare.gov’s Medigap enrollment guide.

Conclusion

Both Plan G and Plan N offer excellent protection against Medicare’s out-of-pocket costs. Plan G gives you maximum coverage with minimal surprises. Plan N saves you money on premiums while still covering the big-ticket items.

For most healthy Texans, Plan N will save $300-600 per year. For those with more complex health needs, Plan G’s predictability may be worth the extra cost.

The best choice depends on your health, how often you see doctors, and how much predictability you want in your healthcare spending.

Ready to compare your options? Contact Wilkerson Insurance Agency today. We’ll help you find the right Medigap plan at the best price for your situation.