Health insurance is expensive. For Texas small business owners, the cost of providing coverage to employees can feel overwhelming. But here’s something many business owners don’t know: you might qualify for tax credits that cover up to 50% of your premium costs.

Yes, you read that right the federal government will pay half your health insurance bill if you meet certain requirements. Let’s look at who qualifies, how much you can save, and how to claim these credits.

What is Small Business Health Care Tax Credit

The Small Business Health Care Tax Credit was created under the Affordable Care Act to help small employers offer health coverage. It’s designed for the smallest businesses, those with lower-wage workers who need the most help.

If you qualify for the full credit, you can get back up to 50% of the premiums you pay toward employee health insurance. For tax-exempt organizations like nonprofits, the credit is up to 35%.

This isn’t a one-time thing either. You can claim this credit for two consecutive tax years, giving you real, ongoing savings. If you’re exploring ways to reduce healthcare costs, our guide on how to reduce health insurance premiums offers additional strategies beyond tax credits.

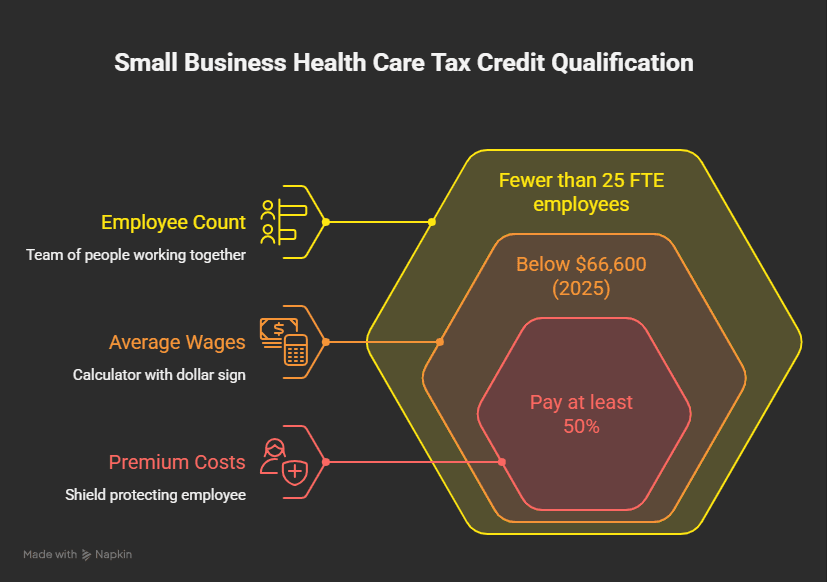

Do You Qualify? The Three Main Requirements

To claim the Small Business Health Care Tax Credit, you need to meet three basic requirements:

Requirement 1: Fewer Than 25 Full-Time Equivalent Employees

You must have fewer than 25 full-time equivalent employees (FTEs). Notice that word “equivalent” means you can have more than 25 people on your payroll if some work part-time.

Here’s how it works: Add up all the hours worked by your employees in a year. Divide by 2,080 (the number of hours in a full-time work year). That gives you your FTE count.

For example, if you have 10 full-time employees and 20 part-time employees who each work 20 hours a week, your FTE count would be about 20.

The maximum credit goes to businesses with 10 or fewer FTEs. The credit phases out as you approach 25 FTEs.

Requirement 2: Average Annual Wages Below $66,600 (2025)

Your employees’ average annual wages must be less than $66,600 in 2025. This number gets adjusted for inflation each year.

To calculate average wages: Take total wages paid to all employees and divide by the number of FTEs.

The full credit goes to businesses paying average wages of $33,300 or less. The credit phases out as average wages approach $66,600.

Requirement 3: You Pay at Least 50% of Employee Premiums

You must contribute at least 50% of the premium cost for employee-only coverage. You don’t have to cover dependent or family coverage, just the employee’s portion.

How Much Can You Actually Save?

Let’s run through a real example:

Lopez Landscaping is a small landscaping company in Irving, Texas. They have 8 full-time employees with an average salary of $28,000. The company pays $4,000 per employee per year toward health insurance (about 60% of the premium).

Total premiums paid by Lopez Landscaping: $32,000 per year

With the full 50% tax credit, Lopez Landscaping saves: $16,000 per year

That’s real money that can go back into the business or help the owner afford better coverage for the team.

Important note: The credit is based on a benchmark premium set by the IRS, so your actual credit might be slightly different if your premiums are higher than average for your area.

The SHOP Marketplace Requirement

Here’s something many Texas business owners miss: to claim the Small Business Health Care Tax Credit, you generally need to purchase your insurance through the SHOP (Small Business Health Options Program) Marketplace.

SHOP is a special health insurance marketplace just for small businesses. It’s part of HealthCare.gov and lets employers with 1-50 employees compare and buy health plans. Visit Healthcare.gov’s SHOP Marketplace to explore plans available in your area.

Benefits of buying through SHOP:

- You can qualify for the tax credit

- Employees can choose from multiple plan options

- You can start coverage any month of the year (not just during open enrollment)

- Plans include all the essential health benefits required by the ACA

Understanding what open enrollment means for small business owners will help you time your SHOP enrollment correctly.

The downside? SHOP plans aren’t available in all areas, and the plan options may be more limited than what you’d find working with a broker. In some Texas counties, SHOP-certified plans are hard to find.

If SHOP isn’t available in your area, talk to an insurance broker about other options that might still offer tax advantages.

Other Tax Benefits for Texas Small Businesses

Even if you don’t qualify for the Small Business Health Care Tax Credit, there are other ways to save:

Business Expense Deduction

Premiums you pay for employee health insurance are generally 100% deductible as a business expense. This reduces your taxable income, which means you pay less in federal and state taxes.

For example, if you pay $50,000 in health insurance premiums and you’re in the 25% tax bracket, you save $12,500 in taxes through the deduction alone. For a complete breakdown, read our article on calculating the real cost of group health benefits.

ICHRA Tax Advantages

If you offer an ICHRA instead of traditional group insurance, your reimbursements are:

- Tax-deductible for your business

- Tax-free for your employees (no income tax or payroll taxes)

This creates savings on both sides of the equation. Learn more about how HSAs provide triple tax advantages that can complement your ICHRA or group plan.

Section 105 Plan Benefits

If you’re a business owner with an S-Corp, you may be able to set up a Section 105 plan to reimburse yourself for health insurance premiums in a tax-advantaged way. The rules are complex, so work with a tax professional.

Upcoming Texas ICHRA Tax Credit (2026)

Texas recently passed legislation creating a franchise tax credit for small businesses (1-50 employees) that switch from traditional group health insurance to ICHRA. This credit is set to take effect in 2026, with applications opening in January 2027.

If you’re considering ICHRA, this upcoming credit could make the switch even more attractive.

How to Claim the Small Business Health Care Tax Credit

Claiming the credit involves a few steps:

Step 1: Gather Your Information

You’ll need:

- Number of FTEs

- Total wages paid

- Total premiums paid toward employee coverage

- Proof of SHOP enrollment (if required)

Step 2: Complete IRS Form 8941

Form 8941 is titled “Credit for Small Employer Health Insurance Premiums.” This is where you calculate your actual credit amount. Download IRS Form 8941 and instructions directly from the IRS website.

The form walks you through:

- Calculating your FTE count

- Determining average wages

- Figuring the credit percentage you qualify for

- Computing your final credit amount

Step 3: Claim the Credit on Your Tax Return

For regular businesses: Include the credit amount as part of the general business credit on your income tax return.

For tax-exempt organizations: Report the credit on Form 990-T, even if you don’t normally file this form.

Step 4: Keep Good Records

Keep copies of:

- Premium payment records

- SHOP enrollment documentation

- Payroll records showing employee hours and wages

- IRS Form 8941

You’ll want these if the IRS ever has questions about your credit.

Common Mistakes That Can Cost You

Mistake 1: Not Knowing the Credit Exists

Many small business owners simply don’t know about this credit. If you qualify, you could be leaving thousands of dollars on the table each year. Many business owners also overlook the hidden costs of skipping health insurance coverage entirely.

Mistake 2: Miscalculating FTEs

Part-time employees count differently than full-time employees. Make sure you’re using the FTE formula correctly, not just counting heads.

Mistake 3: Forgetting to Exclude Certain Workers

When calculating FTEs and average wages, you should exclude:

- Owners and their family members

- Seasonal workers who work 120 days or fewer

- Partners and 2% S-Corp shareholders

Including these workers by mistake could disqualify you or reduce your credit.

Mistake 4: Not Purchasing Through SHOP

If you buy insurance outside of SHOP, you generally can’t claim the credit. Check whether SHOP plans are available in your Texas county before making a decision.

Mistake 5: Missing the Two-Year Limit

You can only claim this credit for two consecutive tax years. Plan accordingly—some businesses wait until they’re ready to maximize the benefit.

Why Choose Us?

At Wilkerson Insurance Agency, we help Texas small business owners find every opportunity to save on health insurance.

- 15+ Years of Experience: We’ve guided countless Dallas-area businesses through the SHOP marketplace and tax credit process

- Personalized Service: We’ll review your specific situation to determine if you qualify and how much you can save

- Deep Knowledge: We stay current on federal tax credits, Texas-specific incentives, and all the latest changes in small business health insurance

- Multiple Options: We can show you SHOP plans, ICHRA options, traditional group coverage, and more—whatever makes the most sense for your taxes and your team

- Ongoing Support: We help with enrollment, renewals, and connecting you with tax professionals when needed

- Free Consultations: Meet with us at no cost to explore your options

While exploring tax credits, don’t forget to review 8 things Texas business owners wish they knew earlier about health insurance that can help you make a more informed decision.

Frequently Asked Questions

Can I claim the tax credit if I use an ICHRA instead of group insurance?

No, the Small Business Health Care Tax Credit is specifically for employers who purchase group health insurance through SHOP. ICHRA has different tax advantages (deductible contributions and tax-free reimbursements), but doesn’t qualify for this particular credit.

What if my business doesn’t owe any taxes this year?

If you’re a for-profit business, you can carry the credit back or forward to other tax years. If you’re a tax-exempt organization, you may be eligible for a refundable credit.

Do I have to offer coverage to part-time employees to qualify?

No, you only need to offer coverage to full-time employees. Part-time employees are counted toward your FTE calculation, but you don’t have to cover them.

What if the SHOP marketplace isn’t available in my area?

This is a real challenge in some rural Texas counties. Talk to an insurance broker about alternatives and other tax-advantaged options like ICHRA or traditional group plans with business expense deductions.

Can I claim both the tax credit and deduct premiums as a business expense?

Yes, but with a catch. You can deduct the portion of premiums that exceed your tax credit. You can’t double-dip on the same dollars, but you can use both benefits together.

Conclusion

If you’re a small Texas business with fewer than 25 employees and modest wages, you may be sitting on a goldmine of tax savings. The Small Business Health Care Tax Credit can cover up to 50% of your health insurance costs for two years that’s thousands of dollars back in your pocket.

Even if you don’t qualify for this specific credit, other tax advantages are available through business expense deductions, ICHRA, and upcoming Texas incentives.

Don’t leave money on the table. Contact Wilkerson Insurance Agency today to see if you qualify and find the most tax-efficient way to offer health coverage to your team.