Medicare Advantage plans sound great on paper: low premiums (sometimes $0), extra benefits like dental and vision, and prescription drug coverage built in. Millions of Texans have signed up.

But for some people, Medicare Advantage doesn’t work out as expected. Maybe you’re frustrated with network restrictions, prior authorizations, or surprise bills. Maybe your health has changed and you need more flexibility.

The good news? You can switch from Medicare Advantage to Original Medicare with a Medigap supplement. The tricky part is knowing when to do it and what it might cost you.

Let’s talk about when switching makes sense, how the process works, and what Texas Medicare beneficiaries need to know.

Medicare Advantage vs Medigap: A Quick Refresher

Medicare Advantage (Part C):

- Private insurance that replaces Original Medicare

- Usually includes prescription drug coverage

- Often has $0 or low premiums

- Uses networks (HMO, PPO, etc.)

- May require referrals and prior authorizations

- Has out-of-pocket maximums (typically $3,000-$8,000/year)

Original Medicare + Medigap:

- Traditional Medicare (Part A and Part B) from the government

- Medigap policy fills the coverage gaps

- Separate Part D plan needed for prescriptions

- No networks see any doctor who accepts Medicare

- No referrals or prior authorizations needed

- Predictable costs (just the Part B deductible with Plan G)

Both approaches have pros and cons. Neither is universally “better” it depends on your situation. Our guide on understanding Medicare Supplement plans in Texas without the jargon can help clarify the differences.

Signs It Might Be Time to Switch from Medicare Advantage

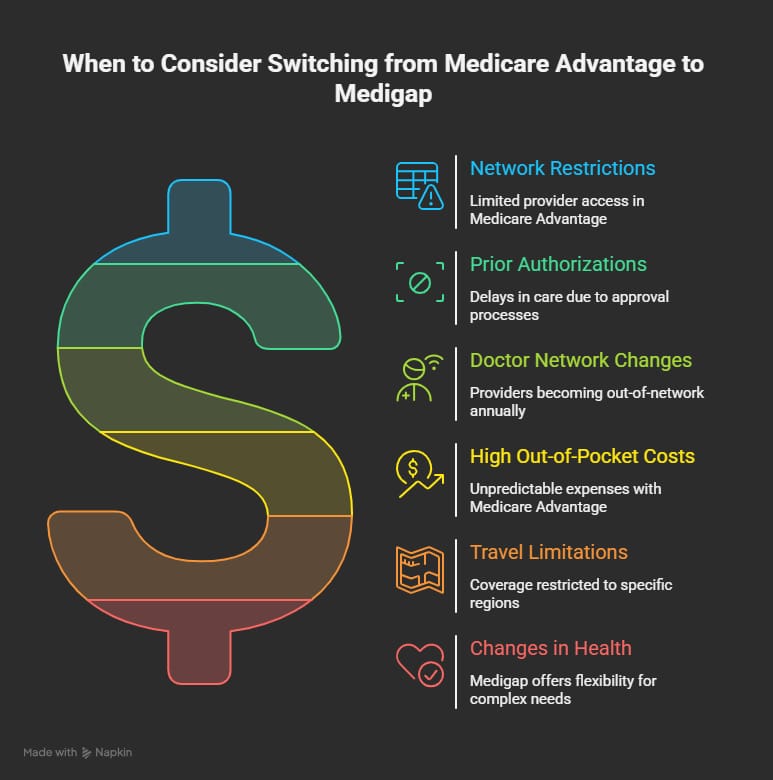

Here are common reasons Texans consider moving from Medicare Advantage to Medigap:

You’re Tired of Network Restrictions

Medicare Advantage plans use networks. If you want to see a specialist who’s out of network, you may pay significantly more or not be covered at all.

With Original Medicare and Medigap, there are no networks. You can see any doctor, specialist, or hospital in the country that accepts Medicare. No referrals needed, no hoops to jump through.

Prior Authorizations Are Slowing Down Your Care

Many Medicare Advantage plans require prior authorization before covering certain tests, procedures, or medications. This means your insurance company has to approve the care before you get it.

Sometimes prior authorizations get denied or delayed, leaving you waiting for care your doctor says you need.

Original Medicare with Medigap has far fewer prior authorization requirements. If your doctor orders it and Medicare covers it, you can typically get the care right away.

Your Plan Changed and Your Doctors Are No Longer In-Network

Medicare Advantage plans can change their provider networks every year. The doctor you’ve been seeing for years might suddenly be out of network, forcing you to switch or pay more.

With Medigap, this isn’t an issue. Your coverage stays the same regardless of which doctors you see.

You’re Facing High Out-of-Pocket Costs

Medicare Advantage plans have out-of-pocket maximums, which sounds good until you realize those maximums can be $5,000, $7,000, or even higher.

If you have a major health event, you could owe thousands before hitting that cap. And you’ll face copays and coinsurance along the way.

With Plan G (the most popular Medigap option), your only cost for Medicare-covered services is the $257 Part B deductible. After that, you pay nothing. Learn more about Medigap demystified: how it reduces financial stress from medical costs.

You Travel or Split Time Between Texas and Another State

Medicare Advantage plans often have limited coverage outside their service area. If you spend winters in Arizona or summers in Colorado, you might not have coverage when you’re away.

Original Medicare with Medigap works nationwide. Any doctor, any hospital, any state you’re covered.

Your Health Has Changed

If you were healthy when you signed up for Medicare Advantage but now have more complex health needs, Medigap might make more sense. The freedom to see specialists without network restrictions or prior authorizations becomes more valuable when you’re dealing with serious health issues.

The Challenge: Medical Underwriting

Here’s the catch that stops many people from switching: outside of certain situations, Medigap insurance companies can use medical underwriting.

Medical underwriting means the insurance company can:

- Ask about your health history

- Deny you coverage based on pre-existing conditions

- Charge you higher premiums based on your health

If you’re in great health, underwriting isn’t a big deal. But if you’ve developed diabetes, heart disease, cancer, or other conditions while on Medicare Advantage, you might find it difficult or expensive to get a Medigap policy.

This is a major consideration. Don’t drop your Medicare Advantage plan before you know whether you can get Medigap coverage.

When You Have Guaranteed Issue Rights (No Underwriting)

In certain situations, Medigap insurance companies must sell you a policy without medical underwriting. These are called “guaranteed issue rights.”

Situation 1: Trial Period After First Joining Medicare Advantage

If you signed up for Medicare Advantage when you first became eligible for Medicare, you have a 12-month “trial period.” During this time, you can leave your Medicare Advantage plan, return to Original Medicare, and buy any Medigap policy in your state without underwriting.

This is a valuable safety net. If you try Medicare Advantage and don’t like it, you have a year to switch back with no health questions.

Situation 2: Dropping Medigap for Medicare Advantage (First Time)

If you already had a Medigap policy and dropped it to try Medicare Advantage for the first time, you also get a 12-month trial period. You can return to your original Medigap policy (if available) or buy a different Plan A, B, C, D, F, G, K, or L without underwriting.

Situation 3: Your Medicare Advantage Plan Leaves Your Area

If your Medicare Advantage plan stops serving your county or leaves the Medicare program entirely, you have guaranteed issue rights. You have 63 days after coverage ends to apply for a Medigap policy.

Situation 4: Your Plan Didn’t Follow the Rules

If your Medicare Advantage plan misled you or broke Medicare rules, you may have guaranteed issue rights. Keep documentation of any problems.

How to Switch from Medicare Advantage to Medigap

If you decide to switch, here’s how the process works:

Step 1: Decide When to Switch

You can leave Medicare Advantage and return to Original Medicare during:

- Medicare Open Enrollment Period (October 15 – December 7): Your Original Medicare coverage starts January 1

- Medicare Advantage Open Enrollment Period (January 1 – March 31): Your Original Medicare coverage starts the first of the month after the plan gets your request

Step 2: Apply for Medigap Coverage

Contact Medigap insurance companies to apply for coverage. If you have guaranteed issue rights, let them know.

If you don’t have guaranteed issue rights, you’ll need to go through medical underwriting. Apply to multiple companies their underwriting standards vary, and one may approve you when another won’t.

Important: Don’t cancel your Medicare Advantage plan until you’re approved for Medigap (unless you’re okay going without supplemental coverage).

Step 3: Enroll in a Part D Prescription Drug Plan

Medigap plans don’t cover prescription drugs. You’ll need a separate Medicare Part D plan for medications.

You can enroll in Part D during the same enrollment periods you use to switch from Medicare Advantage.

Step 4: Cancel Your Medicare Advantage Plan

Once your Medigap coverage is in place, contact your Medicare Advantage plan to cancel. You can also call Medicare directly at 1-800-MEDICARE.

Step 5: Keep Records

Save copies of all letters, notices, and communications. You may need them to prove guaranteed issue rights or resolve any coverage disputes.

What If You Can’t Pass Underwriting?

If you have health conditions that make Medigap underwriting difficult, you still have options:

Stay on Medicare Advantage (For Now)

You don’t have to switch. If you can’t get affordable Medigap coverage, staying on your current Medicare Advantage plan (or switching to a different one) might be the better choice.

Wait for Guaranteed Issue Situations

If your plan leaves your area or you encounter other qualifying events, you may gain guaranteed issue rights in the future.

Look for Plans with Easier Underwriting

Some Medigap carriers have more lenient underwriting than others. Working with a knowledgeable broker can help you identify which companies are most likely to approve your application.

Consider a Medicare SELECT Plan

Medicare SELECT is a type of Medigap policy that requires you to use a specific network of providers (except in emergencies). SELECT plans sometimes have easier underwriting and lower premiums.

Texas-Specific Considerations

A few things Texas Medicare beneficiaries should know:

Texas Doesn’t Have Special Medigap Protections for Under-65 Beneficiaries

Some states require Medigap insurers to sell policies to people under 65 who qualify for Medicare due to disability. Texas is not one of these states. Under-65 beneficiaries in Texas may have very limited Medigap options.

No Ban on Excess Charges

Texas doesn’t prohibit Part B excess charges, unlike some states. If you’re considering Plan N (which doesn’t cover excess charges), know that you could face these bills if your doctor doesn’t accept Medicare assignment though it’s uncommon.

Medigap Plans Are Competitively Priced in Texas

Texas has a robust Medigap market with many carriers competing for business. This means you have plenty of options and can usually find competitive rates. Read our guide on Medicare Supplement plans in 2025: what’s changing and how it affects you for the latest updates.

Why Choose Us?

At Wilkerson Insurance Agency, we help Texas Medicare beneficiaries figure out whether Medigap is right for them and navigate the switch if it is.

- 15+ Years of Experience: We’ve helped countless Texans across Dallas, Plano, Irving, Farmers Branch, and surrounding areas evaluate Medicare Advantage vs Medigap

- Personalized Service: We take time to understand your health situation, travel habits, and preferences before making recommendations

- Deep Knowledge: Our team knows the underwriting standards of different carriers and can help you find coverage even if you have health conditions

- Multiple Options: We work with all major Medigap insurers, so we can show you the full range of available plans and prices

- Ongoing Support: We’re here year-round to answer questions, review your coverage, and help when your needs change

- Free Consultations: There’s no cost to meet with us and explore your options

If you’re also considering adding extra coverage, check out our article on the benefits of adding vision and dental to your Medicare plan.

Frequently Asked Questions

Can I switch from Medicare Advantage to Medigap at any time?

You can only leave Medicare Advantage during specific enrollment periods (October 15 – December 7, or January 1 – March 31). And getting a Medigap policy outside of guaranteed issue situations may require passing medical underwriting.

Will I lose my Medicare Advantage prescription drug coverage?

Yes. When you leave Medicare Advantage, you’ll need to enroll in a separate Part D prescription drug plan.

How long does the switch take?

Your Original Medicare coverage begins the first of the month after you disenroll from Medicare Advantage (or January 1 if you switch during fall enrollment). Time your Medigap enrollment to start on the same date.

What if I want to go back to Medicare Advantage later?

You can switch back to Medicare Advantage during future enrollment periods. However, if you’ve dropped your Medigap policy, you likely won’t be able to get it back without underwriting.

Is Medigap more expensive than Medicare Advantage?

Usually, yes. Medigap premiums are typically $100-250/month, while many Medicare Advantage plans have $0 premiums. But Medigap often has lower total costs for people who use a lot of healthcare, because your out-of-pocket expenses are much more limited.

Conclusion

Switching from Medicare Advantage to Medigap can make sense if you’re frustrated with network restrictions, tired of prior authorizations, or want more freedom to choose your doctors. But the decision isn’t simple especially if you have health conditions that could affect your ability to get Medigap coverage.

The best time to switch is during your first year on Medicare Advantage (when you have guaranteed issue rights) or when you qualify for other guaranteed issue situations. If you’ve been on Medicare Advantage longer, you’ll need to weigh the benefits against the potential challenges of underwriting.

Ready to explore your options? Contact Wilkerson Insurance Agency today. We’ll help you understand whether switching makes sense for your situation and guide you through the process.