Do you know exactly what health insurance your employer offers? If not, you are not alone. Many employees feel confused when they first sign up for work insurance. And if you own a small business, choosing the right plan for your team can feel just as hard.

But picking the right work insurance plan matters a lot. It is not just about having coverage. It is about protecting your health, your money, and your peace of mind.

This guide will help you understand how work insurance plans work and what they cover. By the end, you will feel confident making the best choice for you and your family.

What You Will Learn

- How work insurance is different from individual health plans

- What to expect from employer-sponsored coverage

- How to choose the right plan for your family or business

- Why Wilkerson Insurance Agency in Dallas can help make this process easier

What Is a Work Insurance Plan?

A work insurance plan is health coverage that your employer offers. It is also called employer-sponsored health insurance.

Here is the big difference: with individual health insurance, you pay the full cost yourself. But with work insurance, your employer pays part of it. This usually makes it cheaper for you.

Most work insurance plans are for full-time employees. Many plans also let you add family members like your spouse and kids.

The Affordable Care Act (ACA) requires employers with 50 or more full-time workers to offer health coverage. This means the plan must meet certain standards.

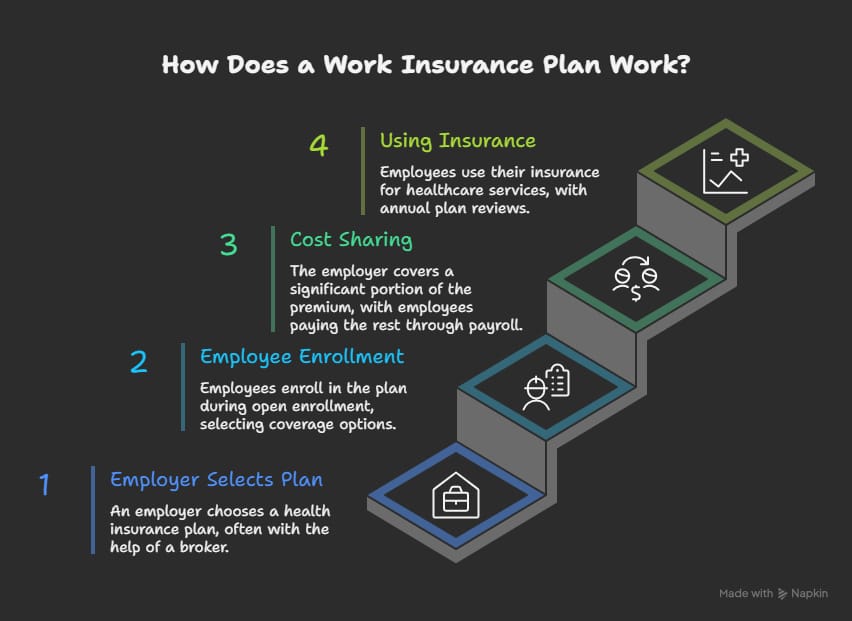

How Does a Work Insurance Plan Work?

A work insurance plan works in four simple steps:

Step 1: Your Employer Picks a Plan Your employer chooses an insurance company. They might work with a broker like Wilkerson Insurance Agency to find the best plan for their team.

Step 2: You Sign Up During open enrollment, you choose your coverage. You can add family members and pick extra benefits like dental or vision.

Step 3: You Split the Cost Your employer pays part of the premium, usually 50% to 80%. You pay the rest. Your share comes out of your paycheck.

Step 4: You Use Your Insurance Once you are enrolled, you can start using your insurance for doctor visits and medical care. Each year, your employer reviews the plan, and costs may change.

What Does the Employer Do?

Your employer has several jobs when it comes to work insurance:

- Choosing the Insurance Company: Employers work with carriers like UnitedHealthcare, Aetna, or Blue Cross Blue Shield.

- Paying Part of the Premium: Employers cover a big chunk of the cost. This saves you money.

- Following the Rules: Employers must make sure their plan follows Texas state laws and federal ACA rules.

Action Step: If you own a small business in Dallas, Carrollton, Irving, or Farmers Branch, Wilkerson Insurance Agency can help you pick the right plan for your team.

What Do You Need to Do as an Employee?

As an employee, you have some jobs too:

- Sign Up on Time: You must choose your coverage during open enrollment. Do not miss this window.

- Know Your Costs: Understand how much will come out of your paycheck each month.

- Pick Your Coverage Level: Decide if you need single coverage or family coverage. Choose any extras like dental or vision.

Three Types of Work Insurance Plans

There are three main types of work insurance plans:

- Fully Insured Group Health Plans: Your employer pays a fixed amount to an insurance company each month. The insurance company takes on all the risk and pays for claims.

- Level-Funded Plans: Your employer pays a fixed monthly fee based on what claims are expected to cost. If claims are lower than expected, the employer may get money back.

- Self-Funded Plans: Your employer pays for employee medical costs directly. They set aside money to cover claims instead of paying an insurance company.

What Does Work Insurance Cover?

Most work insurance plans cover these services:

- Medical Care: Doctor visits, hospital stays, surgeries, and emergency room trips.

- Prescription Drugs: Help paying for medicines your doctor prescribes.

- Preventive Care: Check-ups, vaccines, and health screenings at no extra cost.

- Mental Health Services: Therapy, counseling, and mental health support.

What Work Insurance Usually Does Not Cover

Work insurance plans have some limits. Watch out for these:

- Out-of-Network Care: If you see a doctor who is not in your plan’s network, you may pay much more.

- Cosmetic Surgery: Most plans do not pay for elective cosmetic procedures unless they are medically needed.

- Waiting Periods: Some services may not be covered right away. You may have to wait before coverage starts.

Work Insurance vs. Individual Health Insurance

How do these two types of insurance compare? Here is a quick look:

| Feature | Work Insurance | Individual Insurance |

| Cost | Lower (employer pays part) | Higher (you pay it all) |

| Doctor Choice | Limited to network | More freedom to choose |

| Best For | Employees wanting affordable coverage | People who want more flexibility |

How Much Does Work Insurance Cost in Texas?

In the Dallas-Fort Worth area, the average monthly premium for employer-sponsored health insurance is about $600 to $800 for one person. Here is how the cost is usually split:

| Employer Pays | You Pay | Total Premium |

| $400 to $500 per month | $100 to $300 per month | $600 to $800 per month |

Your actual costs depend on the plan type, how much your employer pays, and what coverage level you choose.

Tax Benefits of Work Insurance

Work insurance comes with some nice tax perks:

- Pre-Tax Premiums: Your premium payments come out before taxes. This means you pay less in taxes.

- Business Tax Deductions: Employers can deduct health insurance premiums as a business expense.

- HSA Benefits: If your plan works with a Health Savings Account (HSA), you can save money tax-free for medical costs.

Work Insurance for Small Businesses

If you own a small business in Dallas, Carrollton, Coppell, Farmers Branch, Irving, or anywhere in the DFW area, offering health insurance can help you:

- Attract and keep good employees

- Keep your team healthy and productive

- Get tax benefits for your business

Having a local broker like Wilkerson Insurance Agency makes the process simple. We know Texas rules and can help you find the best plans for your team.

Common Mistakes to Avoid

Do not make these common mistakes when choosing work insurance:

- Only Looking at the Premium: A cheap plan might cost you more later if it has high deductibles or poor coverage.

- Ignoring the Network: Make sure your doctors and hospitals are in the plan’s network before you sign up.

- Skipping the Yearly Review: Your needs change. Review your plan each year to make sure it still works for you.

Why Pick Our Work Insurance Plans?

At Wilkerson Insurance Agency, we offer more than just insurance policies , we provide personalized, expert guidance to help you make the best decisions for your health coverage needs. With over 15 years of local experience serving the Farmers Beach, Dallas, and surrounding areas , we take the time to understand your individual needs and offer solutions tailored to fit your lifestyle.

- Personalized Expertise: We treat every client like family. Our goal is to make complex insurance decisions simple, clear, and stress-free. Unlike large, impersonal agencies, we take the time to find the best plan for you, based on your specific needs.

- Local Authority: With over 15 years of experience serving the Farmers Beach, Dallas, and surrounding areas, we are deeply familiar with the local health insurance landscape. We understand the unique needs of our community and can guide you through the options that best meet those needs.

- Focus on Value: Our goal isn’t just to find you an insurance plan – we’re committed to finding you the best value. By comparing a wide range of top carriers, we ensure you get the most comprehensive coverage at the best price, without compromising quality.

- Bilingual Service: We understand the importance of clear communication, which is why we offer Spanish-speaking agents to serve the diverse community in Dallas–Fort Worth. We’re here to make sure everyone receives the best support possible, in the language they’re most comfortable with.

Frequently Asked Questions

How is work insurance different from individual health insurance?

Work insurance is paid for partly by your employer, so it usually costs you less. Individual insurance is bought on your own, and you pay the full price. Individual plans often give you more choice in doctors.

Can I say no to my employer’s insurance?

Yes, you can turn down your employer’s plan. But you will need to find other coverage, like an individual plan or a spouse’s plan. Going without insurance can be risky and expensive.

Is work insurance cheaper than private insurance?

Yes, in most cases. Your employer pays part of the cost, which makes it cheaper for you. With private insurance, you pay the whole thing yourself.

Can I add my family to my work insurance?

Yes, most work plans let you add your spouse and children. Some plans also cover domestic partners. Family coverage costs more than single coverage.

What happens to my insurance if I leave my job?

If you leave your job, you may be able to keep your insurance through COBRA. This lets you stay on your employer’s plan for up to 18 months. But you will have to pay the full premium yourself.

Get Started Today

Ready to find the best work insurance plan for you or your business? Call Wilkerson Insurance Agency at (214) 501-9613 or book a free call with LeRoy today.

Wilkerson Insurance Agency is your trusted partner in Dallas, Farmers Branch, Carrollton, Irving, and the entire DFW area. We help you get the right plan, save money, and make healthcare simple. Contact us today!