If you own a small business in Texas, you’ve probably asked yourself this question: “How can I offer health insurance to my team without spending a fortune?” You’re not alone. Texas has over 3.2 million small businesses, yet only about 32% offer health coverage to their employees. The main reasons? High costs and confusing options.

The good news is there’s a newer option that’s changing the game for Texas employers called ICHRA. But is it better than traditional group health insurance? Let’s break it down in plain English so you can make the right choice for your business.

What is ICHRA and How Does It Work?

ICHRA stands for Individual Coverage Health Reimbursement Arrangement. It’s a fancy name for a simple idea: instead of buying a group health plan for everyone, you give your employees a set amount of money each month to buy their own health insurance.

Here’s how it works:

- You decide how much you want to give each employee (there’s no minimum or maximum)

- Employees use that money to buy their own health plan from the marketplace or a private insurer

- They submit their receipts, and you reimburse them tax-free

- Any money they don’t use stays with you

If you’re new to health reimbursement arrangements, our guide on maximizing your HSA for healthcare expenses explains how tax-advantaged accounts work alongside options like ICHRA.

ICHRA became available in 2020 when the federal government changed the rules to let employers use HRAs for individual health plans. You can learn more about ICHRA regulations directly from the U.S. Department of Labor’s ICHRA fact sheet. Since then, it’s become popular with small businesses across Texas from restaurants in Houston to tech startups in Austin.

What is Traditional Group Health Insurance?

Traditional group health insurance is what most people think of when they hear “employer health coverage.” You buy a single policy that covers all your employees (and often their families too). Everyone gets the same plan options, and you share the cost with your workers.

With group plans:

- The insurance company sets the premium based on your group’s age and health

- You usually need at least 2-50 employees to qualify

- In Texas, carriers typically require 60-75% of employees to sign up

- You pick one or two plans, and everyone chooses from those options

Group plans have been around for decades, and they’re still the most common way employers offer health benefits. For a deeper look at how group coverage benefits your team, read our article on how small businesses benefit from group health insurance.

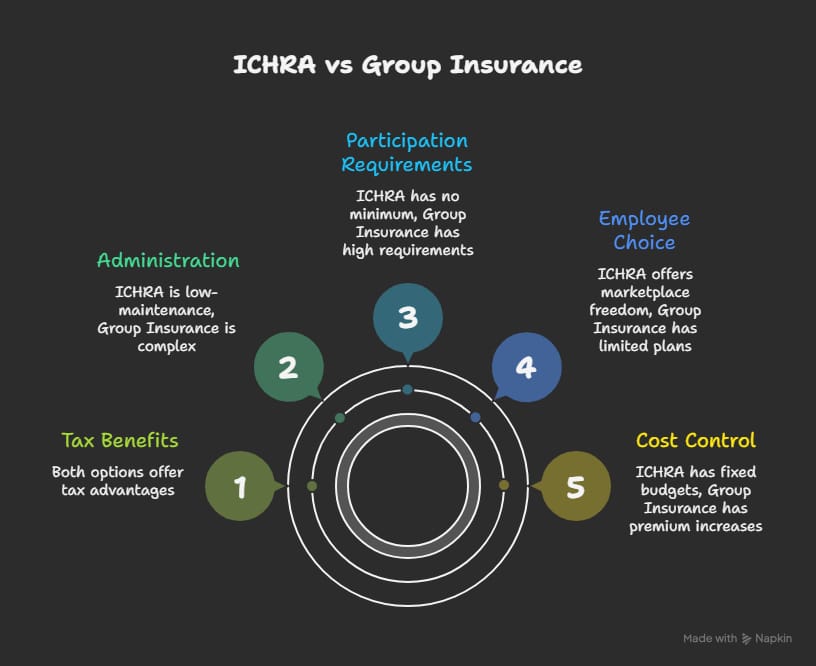

ICHRA vs Group Insurance: A Side-by-Side Comparison

Let’s look at how these two options stack up:

Cost Control

With ICHRA, you set a fixed budget. You decide exactly how much you spend each month, and that number doesn’t change. No surprise rate hikes at renewal time.

With group insurance, your premium can jump 10-25% at renewal. You’re at the mercy of your group’s claims history and the insurance company’s pricing.

Employee Choice

ICHRA lets employees pick any plan they want from hundreds of options on the marketplace. A 25-year-old single employee might pick a low-cost Bronze plan, while a 55-year-old with a family might choose a PPO with better coverage.

Group plans offer limited choices, usually just 2-3 options. Everyone has to fit into the same box, even if it doesn’t match their needs.

Participation Requirements

ICHRA has no participation requirements. Even if only one employee uses the benefit, you can still offer it.

Group plans in Texas typically need 60-75% of eligible employees to sign up. If you can’t meet that threshold, carriers may deny your application or make you wait until open enrollment.

Administration

ICHRA is simpler to manage. Employees handle their own enrollment and plan selection. You just reimburse them.

Group plans require more hands-on work: managing enrollments, tracking life events, handling COBRA, and dealing with carrier renewals.

Tax Benefits

Both options offer tax advantages. With ICHRA, your reimbursements are tax-free for employees and tax-deductible for your business. Group insurance premiums are also deductible, and employee contributions are typically pre-tax.

Understanding the triple tax advantage of HSA plans can help you decide which approach maximizes your tax savings.

When ICHRA Makes More Sense for Texas Businesses

ICHRA might be the better choice if:

- You have a small team (under 20 employees)

- Your employees are spread across different Texas cities like Dallas, Houston, Austin, or San Antonio

- You want predictable monthly costs with no surprises

- Your team has diverse needs some young and healthy, some older with families

- You’ve struggled to meet participation requirements for group plans

- You’re a startup or seasonal business with changing employee counts

Texas is actually one of the states pushing to make ICHRA more attractive. Starting in 2026, Texas small businesses with 1-50 employees may qualify for a franchise tax credit when they switch from traditional group insurance to ICHRA.

When Traditional Group Insurance Makes More Sense

Group insurance might be the better fit if:

- You have a larger, stable workforce (25+ employees)

- Your employees value the simplicity of a single plan

- You want to offer richer benefits like PPO plans with large networks

- Your team is relatively healthy, and you’ve had good renewal rates

- You’re in an industry where group coverage is expected (like healthcare or finance)

If you’re leaning toward group coverage, check out our post on what open enrollment means for small business owners to understand the enrollment process.

Keep in mind that group plans offer access to broader PPO networks, while individual marketplace plans in Texas are mostly HMO or EPO plans. If your employees want to see out-of-network doctors, group insurance may be the better option. Understanding the differences between HMO vs PPO vs EPO vs POS plans can help your team make smarter choices.

What About the Cost Difference?

Let’s talk about real numbers. In 2025, the average small business health insurance premium in Texas is about $9,325 per year for single coverage and around $26,993 for family coverage. Employers typically pay 75% of these costs.

With ICHRA, Texas employers can set their allowance anywhere from $200 to $500+ per month per employee. The average ICHRA allowance nationwide is around $400-500 for single employees.

Here’s a quick example:

Scenario: A Dallas-based marketing agency with 10 employees

- Group Plan: $9,000/year per employee (employer pays 75%) = $6,750/year per employee = $67,500 total

- ICHRA: $500/month allowance = $6,000/year per employee = $60,000 total

In this case, ICHRA saves $7,500 per year while giving employees more choice. Plus, if claims are low with ICHRA, you keep the unused funds.

Common Concerns About ICHRA (And the Reality)

“My employees won’t know how to pick their own plan.”

Most ICHRA administrators provide support and shopping tools to help employees choose. Plus, younger workers are often comfortable shopping for insurance online. We’ve also covered 10 mistakes people make when buying individual health insurance helpful reading for employees choosing their own plans.

“What about employees who get marketplace subsidies?”

If you offer an “affordable” ICHRA (meeting IRS standards), employees can’t also receive premium tax credits from the marketplace. But if your contribution is generous enough, this usually isn’t a problem.

“Is ICHRA ACA compliant for larger employers?”

Yes. If you’re an Applicable Large Employer (50+ employees), ICHRA can satisfy your ACA obligations as long as it meets affordability standards.

Why Choose Us?

At Wilkerson Insurance Agency, we help Texas business owners find the right health insurance solution whether that’s ICHRA, traditional group coverage, or something else entirely.

- 15+ Years of Experience: We’ve helped hundreds of Dallas-area businesses find affordable health coverage

- Personalized Service: We take time to understand your business, your budget, and your employees’ needs before recommending anything

- Deep Knowledge: Our team stays current on all the latest options, including ICHRA, level-funded plans, and SHOP marketplace coverage

- Multiple Options: We’re not tied to one carrier, so we can show you plans from Blue Cross Blue Shield, UnitedHealthcare, Aetna, Cigna, and more

- Ongoing Support: We’re here year-round to answer questions, handle renewals, and help with employee issues

- Free Consultations: There’s no cost to meet with us and explore your options

Before making your decision, it’s worth understanding how to choose the right family health insurance plan since many employees will be covering their families through either option.

Frequently Asked Questions

Can I offer ICHRA to some employees and group insurance to others?

Yes, but with limits. You can offer different benefits to different “classes” of employees (like full-time vs part-time, or salaried vs hourly). But you can’t offer both ICHRA and group insurance to the same class of employees.

What happens if an employee doesn’t use all their ICHRA money?

Unused ICHRA funds stay with the employer. Unlike HSAs, ICHRA money doesn’t roll over for employees.

Is ICHRA available for businesses of any size?

Yes. ICHRA works for businesses with 1 employee all the way up to thousands. There’s no size limit.

How do I set up ICHRA for my Texas business?

You’ll need to work with an ICHRA administrator or a knowledgeable insurance broker. They’ll help you create the plan documents, set contribution levels, and handle compliance.

Can my employees keep their doctors with ICHRA?

It depends on which plan they choose. Since employees pick their own coverage, they can select a plan that includes their preferred doctors in-network.

Conclusion

Both ICHRA and traditional group health insurance have their place. ICHRA offers more flexibility, cost control, and employee choice making it ideal for many Texas small businesses. Traditional group plans offer simplicity and broader PPO networks, which some employers and employees prefer.

The best choice depends on your business size, budget, employee needs, and how much flexibility you want. At Wilkerson Insurance Agency, we can help you compare both options side-by-side and find what works best for your situation.

Ready to explore your options? Give us a call or stop by our office in Dallas. We’d love to help your Texas business find the right health insurance fit.